In this week's brief, we're exploring new deals to unlock financing for nature, Alphabet's secret project to tackle plastics, and the economic benefits of installing EV chargers for retailers. And ahead of Thanksgiving next week in the United States, we're also releasing our new explainer on the impact of food waste.

Follow Tectonic on Instagram and LinkedIn for regular updates about the innovators and innovations moving climate ambition into action.

$300 million debt swap in The Bahamas unlocks resources for ocean conservation: Standard Chartered Plc has completed a $300 million debt swap with The Bahamas, allowing the country to refinance its debt and allocate savings to ocean conservation. The deal was arranged with the Nature Conservancy and backed by a partial guarantee from the Inter-American Development Bank, as well as guarantees from Lucas Walton's philanthropic platform Builders Vision and credit insurance from Axa XL. The deal results in the country swapping expensive, short-term debt for cheaper, longer-term arrangements. Savings will be used to protect mangroves, coral reefs, and seagrass meadows.

Africa presents opportunities for debt-for-nature swaps: Standard Chartered's chief sustainability officer, Marisa Drew, highlighted Africa as a prime location for debt-for-nature swaps due to the deep discount at which many African countries' debt trades. Drew, who helped pioneer the first sizable debt-for-nature swap, a $553 million deal for Belize in 2021, notes that any country under stress now sees this as a potential solution. Only one large debt-for-nature swap has been concluded in Africa, a $500 million deal between The Nature Conservancy and Gabon for marine conservation. Other countries such as Zambia, Kenya, and Angola have expressed interest in doing similar deals, and The Nature Conservancy (TNC) is exploring debt-for-nature swaps and blue bond sales to support marine conservation efforts in southern Africa, specifically in South Africa, Namibia, and Angola. TNC approached Angola about possibly conducting a swap as part of the Blue Benguela Partnership, which aims to create an additional 148,000 square kilometers of marine conservation areas.

“Any country that’s under stress is now seeing this as a potential solution. It has applicability across a lot of African countries and we see a lot of keen interest. The more we can start to have a systematic approach, the more that you can then scale these.” - Marisa Drew, Chief Sustainability Officer, Standard Chartered Plc

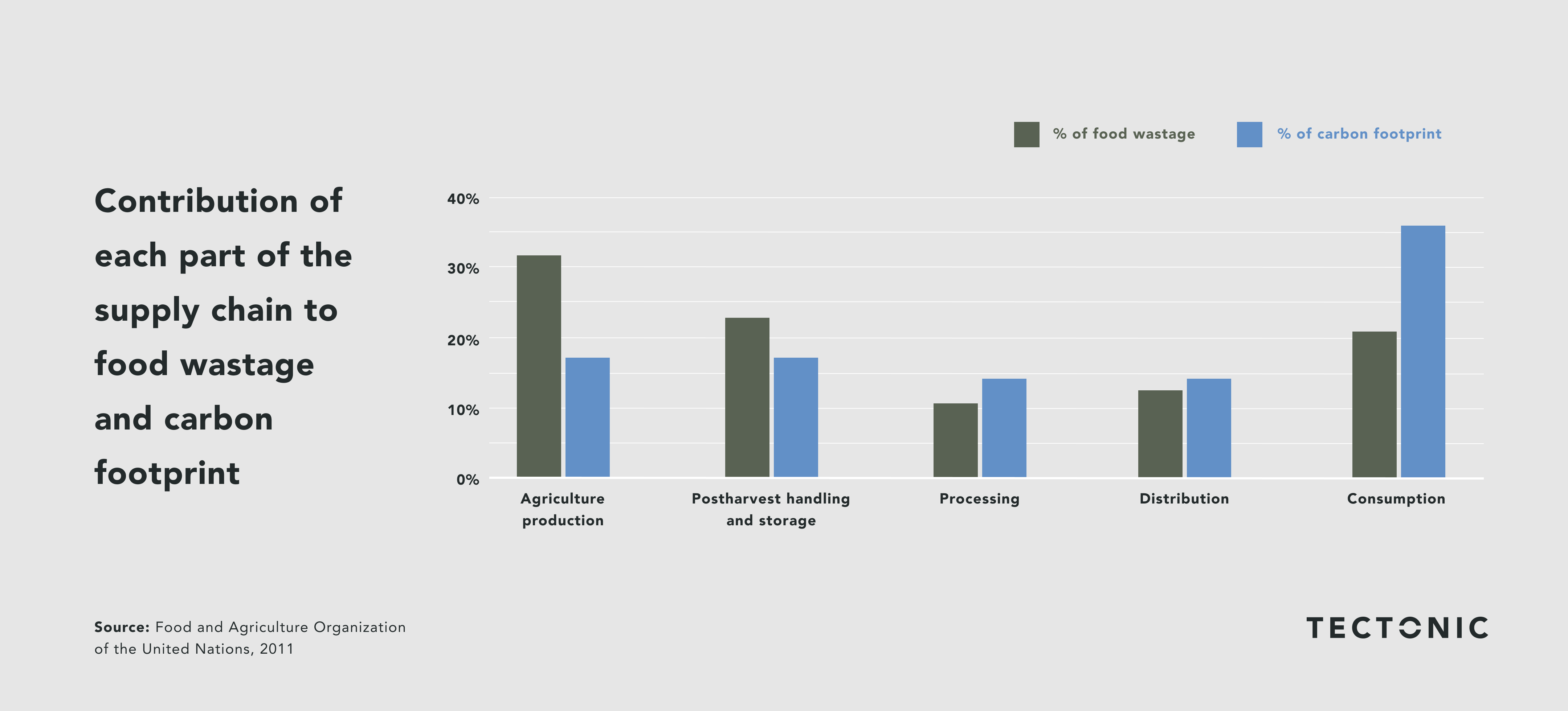

Our new explainer on the climate impact of food waste: Globally, around one-third of all food produced is lost or wasted, amounting to roughly 1.3 billion tons annually. According to the United Nations, if food waste was a country, it would rank third in emissions, after China and the United States. Our new explainer, Beyond the Bin: How to Reduce the Climate Impact of Food Waste, explores how innovative interventions are helping to reduce waste and its associated emissions.

Alphabet's project to tackle plastic waste: Alphabet has launched a project called X Moonshot for Circularity. The project utilizes Alphabet's computing power, data skills, and artificial intelligence to identify and sort various types of plastics in real time to create a "molecular inventory management platform." The team has developed a system capable of identifying types of plastic by their molecules in real-time, processing thousands of pieces per minute on recycling plant conveyor belts, and creating a database to store the information for future use. The initiative is also exploring mechanical and chemical recycling methods, with the ultimate vision of applying this technology to other hard-to-decarbonize materials, such as steel, concrete, batteries, electronics, and textiles.

The US backtracks on plastics treaty: The Biden Administration reversed its stance on supporting a cap on plastic production as part of the United Nations' global plastics treaty, instead opting for a "flexible" approach with voluntary targets for reducing plastic production. This decision was communicated to representatives from five environmental organizations in a closed-door meeting, contradicting a previous briefing in August where the administration expressed support for limits on plastic production. A White House spokesperson clarified that while the U.S. endorses an "aspirational global goal" to reduce plastic production, they do not support a production cap and believe there are different paths to achieving reductions.

UAE climate fund slow to invest: The UAE’s landmark climate fund, Altérra, launched a year ago at COP28 with a goal of investing $30 billion in the energy transition but has only spent a small fraction of its cash, with actual funds spent significantly lower than the committed $6.5 billion. Alterra's CEO, Majid Al Suwaidi, said the fund is trying to create "solutions that are sustainable and scalable" but is facing a lack of investible opportunities in energy transition, particularly in developing countries and emerging markets. The shortage of bankable climate projects has emerged as a major theme in private finance, threatening to slow overall investment. Alterra has invested in seven strategies managed by BlackRock Inc., Brookfield Asset Management Ltd., and TPG Inc., but some of these funds are new and in the early stages of raising money.

$160 million raised for climate AI: Blue Bear Capital has secured $160 million in funding for its third fund, which will focus on backing AI founders in the climate, energy, and industry sectors. According to Ernst Sack, partner at Blue Bear, AI can be applied universally across various industries, including wind, water treatment, refrigeration, steel, cement, chemicals production, and marine and aviation logistics. Blue Bear plans to invest in around 15 companies, with a typical initial check size of $5 million and an additional $10 million reserved for follow-on investments.

$200 million in deals for sustainable aviation fuels: BlackRock, Block, Samsara, and Ripple are participating in the Sustainable Aviation Buyers Alliance, a group that has secured $200 million in clean jet fuel deals to promote the use of sustainable aviation fuel (SAF). The purchase will add SAF to Alaska Air Group Inc. passenger flights, offsetting the companies' business travel emissions, and is expected to abate around half a million tons of carbon dioxide over the next five years. Companies are purchasing SAF certificates to cut costs and spur more production, allowing them to count the carbon cuts tied to the certificate against their indirect or Scope 3 emissions. The deals will buy approximately 50 million gallons of SAF, equivalent to about 3,000 flights from New York to London, and will be produced by Montana Renewables using fat, oil, and grease.

President Biden promises support for climate action in Brazil: President Biden became the first sitting American president to visit the Amazon rainforest in Brazil and pledged new financial help to protect the planet's largest tropical rainforest. During his visit, Biden signed a proclamation declaring November 17 as International Conservation Day and vowed that the United States would spend millions of dollars on various environmental initiatives in the Amazon, including restoring land, planting native tree species, supporting biodiversity efforts, and increasing fertilizer efficiency programs.

Climate-positive buildings: The Powerhouse initiative in Norway aims to offset the significant carbon emissions associated with building construction, which accounts for around 40% of global carbon emissions and is expected to increase as operational emissions decrease. The program features buildings designed to be "energy positive," meaning they produce more energy than they consume over their lifetime, including the energy used for construction and eventual demolition. The initiative has built five Powerhouses in Norway so far, with plans to expand to other locations and explore alternative energy sources such as wave energy, kinetic energy from roads, wind, and geothermic energy.

Chinese EVs offer a range of innovative features: The main appeal of Chinese electric vehicles (EVs) to foreign buyers is their high quality and affordability, with prices that Western carmakers cannot match, even with import tariffs. BYD's vehicles, for example, offer rotating touchscreens that can swivel between landscape and portrait modes, while the Atto-3 model features unique guitar-like strings on its door panels and a gear selector inspired by a rocket ship. The Yangwang U8 SUV has a "tank turn" feature that allows it to spin its wheels in different directions and a "floating" mode that enables it to drive on water in emergencies. Chinese new-car buyers, who are, on average, around 35 years old and tech-savvy, are driving the demand for vehicles loaded with advanced features, which Chinese firms are catering to.

Retailers benefit from nearby EV chargers: A study by researchers at Boston University and the University of Wisconsin-Madison found the installation of nearly 1,600 Tesla Supercharger stations in over 800 U.S. counties led to a 4 percent increase in monthly visits for retailers within 200 meters of chargers and a 5 percent increase in spending. Another study published in Nature Communications analyzed data from California and found that installing chargers brought modest increases in foot traffic and spending, attracting higher-income visitors and local residents and enhancing businesses in low-income areas. Companies like Walmart now see charging as a potentially profitable business on its own, building charging stations under their brand names rather than relying on providers.